thinkorswim® trading platforms give you the power to go deeper.

With award-winning thinkorswim® trading platforms, you get powerful features and real-time insights that let you dive deeper into the market and your trading strategies. Not just one platform but three, thinkorswim meets you where you are—to fit with your trading style, skill level, and preferred way to trade.

thinkorswim desktop

No-holds-barred trading experience.

The flagship of the platform suite, this fully customizable trading software provides access to elite trading tools that give you the power to test your strategies, develop new ideas, and place even the most complex trades.

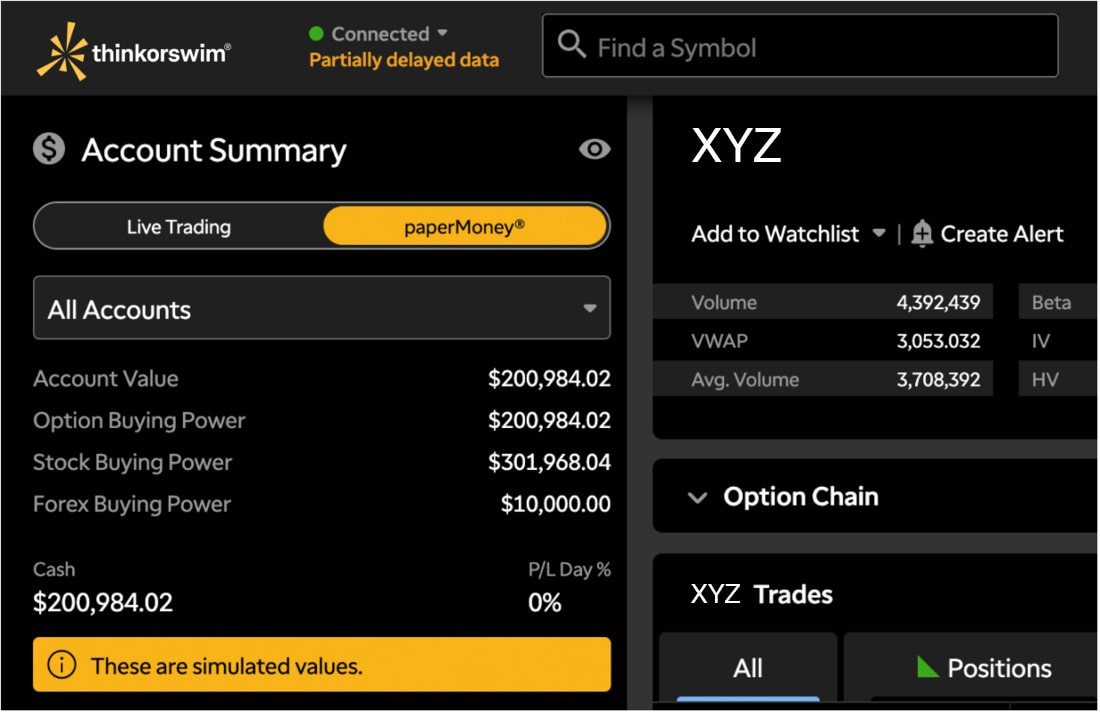

thinkorswim mobile

Desktop trading power that fits in your pocket.

A one-stop trading app that packs many features of thinkorswim desktop into the palm of your hand. Stay connected to the market on the go with this secure trading platform—optimized specifically for mobile.1

thinkorswim web

Streamlined trading—optimized for action.

This web-based platform takes the essential functionality from thinkorswim desktop and packages it into an intuitive online trading interface. Available from almost any browser—no download necessary.

What you get with thinkorswim.

Robust charting and analysis

Choose from hundreds of technical indicators, studies, and drawing tools to help you better visualize potential risks and opportunities with your trades.

Built-in insights and education

From expert commentary and live-streaming news, to on-demand education via the Learning Center and Schwab Coaching®, our educational resources let you expand your knowledge without taking your eyes off your trading.

Focus on continual innovation

Your feedback is key to keeping thinkorswim as innovative as possible. That's why we sort through in-app comments, platform analytics, phone calls, and social media to fuel future updates.

Broad range of products

Act on nearly any trade idea with stocks, ETFs, options, futures2, and forex2. Plus get 24/5 trading for over 1,100 stocks and ETFs.

Trading at Schwab is powered by Ameritrade.

Award-winning thinkorswim platforms.

Trade with cutting-edge tools and technology made for traders, by traders.

More trading education than ever before.

Sharpen your skills with an expanding library of resources tailored to traders.

Real support from real traders.

Get platform, product, and trading strategy support from a Trade Desk team of trading specialists.

Commission-free trading experience.

Trade listed equities online for $0 commission and options for $0.65 per contract.4

Have questions? Let's talk.

Call

thinkorswim trading platform FAQs:

Yes. Schwab clients get access to the thinkorswim® platform suite for no charge. However, when it comes to trades placed through each platform, Schwab's standard pricing applies.

A Schwab account is required to log in to thinkorswim platforms. If you don't have a Schwab account but are looking for a way to see what it's like to trade with thinkorswim, you can do that via a Guest Pass.

thinkorswim trading platforms are good for both beginners and advanced traders alike. If you're just getting started with trading, Schwab can help grow your knowledge and skills with a wide array of live and on-demand education designed for traders at all levels. And you can always talk to one of our trading specialists, they're available 24/7.

The first step towards trading on any thinkorswim platform is to open an account and add funds via electronic (ACH) transfer, wire transfer, or by depositing a check.

There is no minimum funding amount required to open a Schwab account and use thinkorswim trading platforms, however there are account minimums and certain other requirements that must be met to trade specific products like options.

Yes, you can day trade on thinkorswim. You'll need a Schwab brokerage account in order to use thinkorswim trading platforms, and to day trade, you'll also need to be margin approved and maintain a minimum equity of $25,000 in the account at all times. On thinkorswim, each day's Day Trade Buying Power is displayed within the platform, so you can see the amount of marginable stock you can day trade without incurring a margin call.5